A tax of

.00 per gallon on gasoline – The imposition of a $1.00 per gallon tax on gasoline has sparked a multifaceted debate, raising questions about its impact on consumers, the economy, the environment, and society. This comprehensive analysis delves into the potential consequences of this tax, exploring its implications and examining alternative solutions.

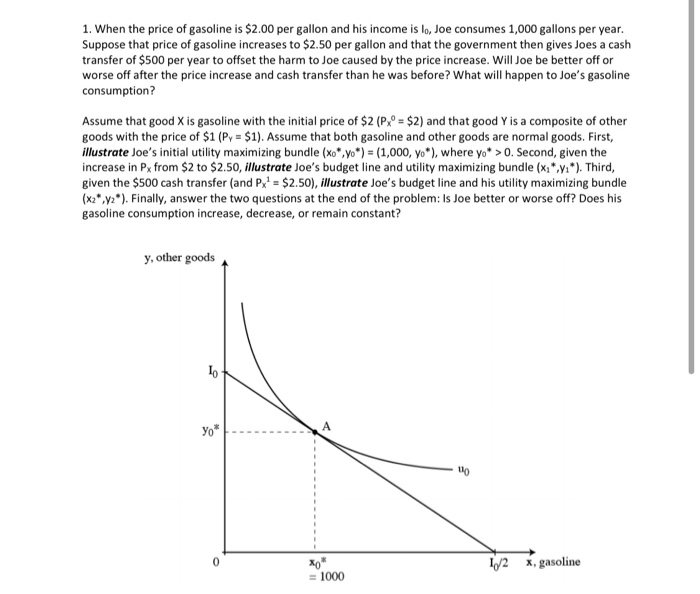

Impact on Consumers

The proposed tax would have a significant impact on household budgets, particularly for low-income and rural communities. The average household in the United States consumes approximately 600 gallons of gasoline per year, resulting in an additional annual cost of $600 under the proposed tax.

Low-income households spend a larger proportion of their income on transportation, making them particularly vulnerable to the tax’s impact. Additionally, rural communities often lack access to public transportation, making them heavily reliant on personal vehicles.

Disproportionate Impact

- Low-income households spend a larger proportion of their income on transportation, making them more sensitive to the tax’s impact.

- Rural communities often lack access to public transportation, making them heavily reliant on personal vehicles.

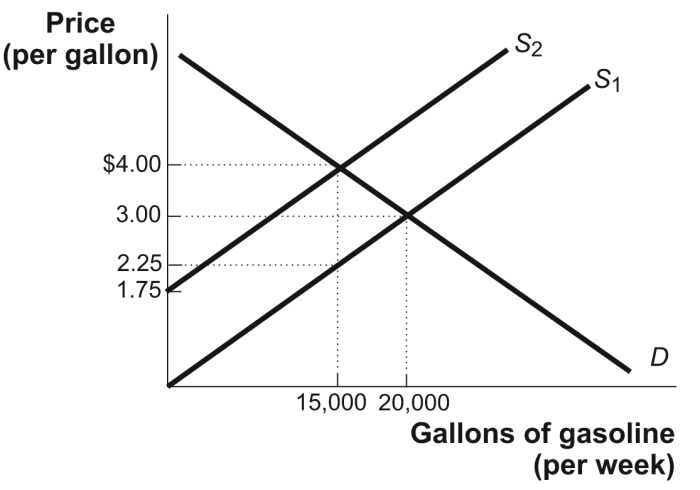

Economic Consequences

The tax would also have a significant impact on the transportation industry, potentially disrupting supply chains and increasing logistics costs. The increased cost of fuel would lead to higher prices for goods and services, potentially slowing economic growth and job creation.

However, the tax could also create opportunities for investment in alternative energy sources and fuel-efficient technologies.

Transportation Industry

- The tax would increase the cost of fuel, leading to higher prices for goods and services.

- The tax could also create opportunities for investment in alternative energy sources and fuel-efficient technologies.

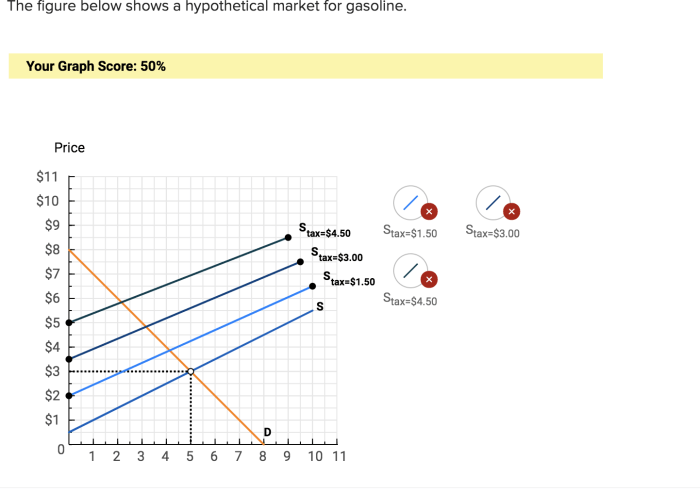

Environmental Implications

The tax could have positive environmental benefits by reducing greenhouse gas emissions from vehicles. However, it could also lead to unintended consequences, such as increased vehicle miles traveled due to reduced fuel efficiency.

To mitigate these potential negative impacts, the tax could be combined with other measures, such as carbon pricing or fuel economy standards.

Greenhouse Gas Emissions, A tax of

.00 per gallon on gasoline

- The tax could reduce greenhouse gas emissions from vehicles.

- The tax could also lead to unintended consequences, such as increased vehicle miles traveled due to reduced fuel efficiency.

Political and Social Considerations: A Tax Of

.00 Per Gallon On Gasoline

.00 Per Gallon On Gasoline

The political feasibility of the tax is uncertain, with potential opposition from industries affected by the increased cost of fuel. However, the tax could also gain support from environmental groups and individuals concerned about climate change.

The tax could also have social impacts, such as increased public transportation usage or reduced driving. These impacts could have both positive and negative consequences, depending on the specific circumstances.

Political Feasibility

- The political feasibility of the tax is uncertain, with potential opposition from industries affected by the increased cost of fuel.

- The tax could also gain support from environmental groups and individuals concerned about climate change.

Social Impacts

- The tax could have social impacts, such as increased public transportation usage or reduced driving.

- These impacts could have both positive and negative consequences, depending on the specific circumstances.

Alternative Solutions

There are a number of alternative solutions that could be considered to address the issues targeted by the tax, such as investing in public transportation or promoting fuel-efficient vehicles.

These alternatives have their own advantages and disadvantages, and the best solution will depend on the specific circumstances.

Alternative Solutions

- Investing in public transportation

- Promoting fuel-efficient vehicles

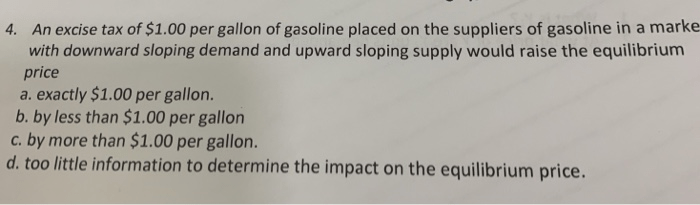

FAQs

What is the potential impact of a $1.00 per gallon tax on household budgets?

The tax could significantly increase household transportation costs, particularly for low-income and rural communities that rely heavily on personal vehicles.

How might the tax affect the transportation industry?

The tax could increase transportation costs for businesses, potentially impacting supply chains, logistics, and economic growth.

What are the potential environmental benefits of the tax?

The tax could reduce greenhouse gas emissions by encouraging fuel efficiency and promoting alternative transportation modes.